I. Introduction

On January 15, 2026, Triangle Tire Co., Ltd. announced an investment of 3.219 billion RMB to establish its first overseas production base in Svay Rieng Province, Cambodia. The project is planned to have an annual capacity of 7 million high-performance radial tires and is expected to generate approximately 2.585 billion RMB in annual revenue for the company.

This move brings the total number of Chinese tire companies with investments, ongoing projects, or planned projects in Cambodia to 10 for the first time, marking Cambodia’s emergence as a significant hub for the overseas expansion of China’s tire industry and a major center for Cambodia tire production. The growing cluster of C Cambodia tire manufacturers is fundamentally reshaping the regional supply chain.

II. Project Overview: Triangle Tire’s Strategic Leap

The Triangle Tire Cambodia project is scheduled to commence construction in March 2026, with a 17-month build-out period. The product mix includes 6 million PCR tires and 1 million TBR tires annually. This new china tire factory will be implemented through a wholly-owned subsidiary, with funding coming from the company’s own capital and bank loans.

For Triangle Tire, this base represents a critical step in upgrading its global production and operations. Once operational, it will synergize with domestic production capacity, optimize resource allocation, enhance resilience against international trade risks, and hold strategic importance for securing its global market position.

III. Why Cambodia? Drivers Behind the Investment Surge

The rise of cambodia tire manufacturers is driven by concrete advantages:

- Navigating Trade Winds: Facing tariffs in key markets, establishing a china tire factory offshore in Cambodia offers a pathway to mitigate trade barriers and access broader international markets.

- Cluster and Cost Benefits: Cambodia provides rich natural rubber resources, favorable investment policies, and growing industrial synergy. Local production reduces logistics costs and enhances supply chain efficiency for tires made in cambodia.

- Strategic Location: As an ASEAN and RCEP member, Cambodia offers advantageous market access, making it an ideal location for a china tire factory aiming for global competitiveness.

IV. Industry Momentum: Cambodia’s Tire Manufacturing Rise

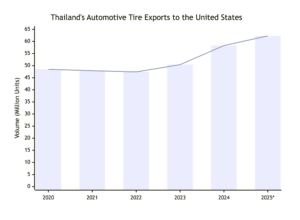

Triangle Tire’s investment is part of a broader wave of Chinese tire companies building factories overseas. Since 2025, Linglong Tire announced a plant in Brazil, and Sailun Tire‘s Indonesian factory produced its first tire. The industry’s global footprint is evolving from single locations to a coordinated multi-regional network. Market research data indicates stable growth expectations for key tire markets like North America in the coming years, providing space for overseas capacity. Cambodia, with its resources, policies, and trade agreement advantages, has become a pivotal node in the global network of Chinese tire manufacturers.

Cambodian tire factory of a Chinese tire company

| No. | Status | Company | Commencement Year | PCR (10k units/year) | TBR (10k units/year) | Total (10k units/year) |

| 1 | Operational | General Tire | 2022 | 850 | 165 | 1015 |

| 2 | Sailun | 2021 | 1500 | 165 | 1665 | |

| 3 | Double Star | 2024 | 700 | 150 | 850 | |

| 4 | Fumais | 2024 | 120 | 800 | 920 | |

| 5 | Wanli | 2025 | 1200 | 240 | 1440 | |

| 6 | Zhengdao | 2024 | 600 | 120 | 720 | |

| 7 | Frico | 2024 | 800 | 320 | 1120 | |

| 8 | Planned | New Continent | 2025 | 450 | — | 450 |

| 9 | Huasheng Rubber | 2025 | — | — | — | |

| 10 | Triangle Tire | 2026 | 600 | 100 | 700 |

IV. The Broader Trend: Reshaping Global Supply Chains

The expansion of cambodia tire manufacturers is part of a strategic recalibration by Chinese tire firms. Moving production closer to raw materials and key markets optimizes global networks. Each new china tire factory in Cambodia strengthens the regional cluster, enhancing scale and supply chain resilience for all participants.

V. Conclusion

In summary, Triangle Tire’s decision to build a factory in Cambodia is based on a comprehensive assessment aimed at mitigating trade risks, leveraging locational cost advantages, and integrating into the existing industrial cluster. This move not only reflects the deepening of the company’s own global strategy but also underscores the broader industry trend of Chinese tire manufacturing proactively relocating capacity overseas to adapt to shifting international trade patterns and optimize supply chain layouts.

As production capacities of multiple Chinese tire companies come online in Cambodia, the country is poised to develop into a regional tire manufacturing and export center. Concurrently, the international competitiveness of China’s tire industry is being reshaped and enhanced through this new global configuration.